The companies that have gone public since the last Diwali have delivered exceptional returns in a surging secondary market. Out of the 56 companies that went public since Diwali 2022, collectively raising a staggering Rs 47,890 crore from the primary market, the shares of 48 firms are currently trading above their issue price.

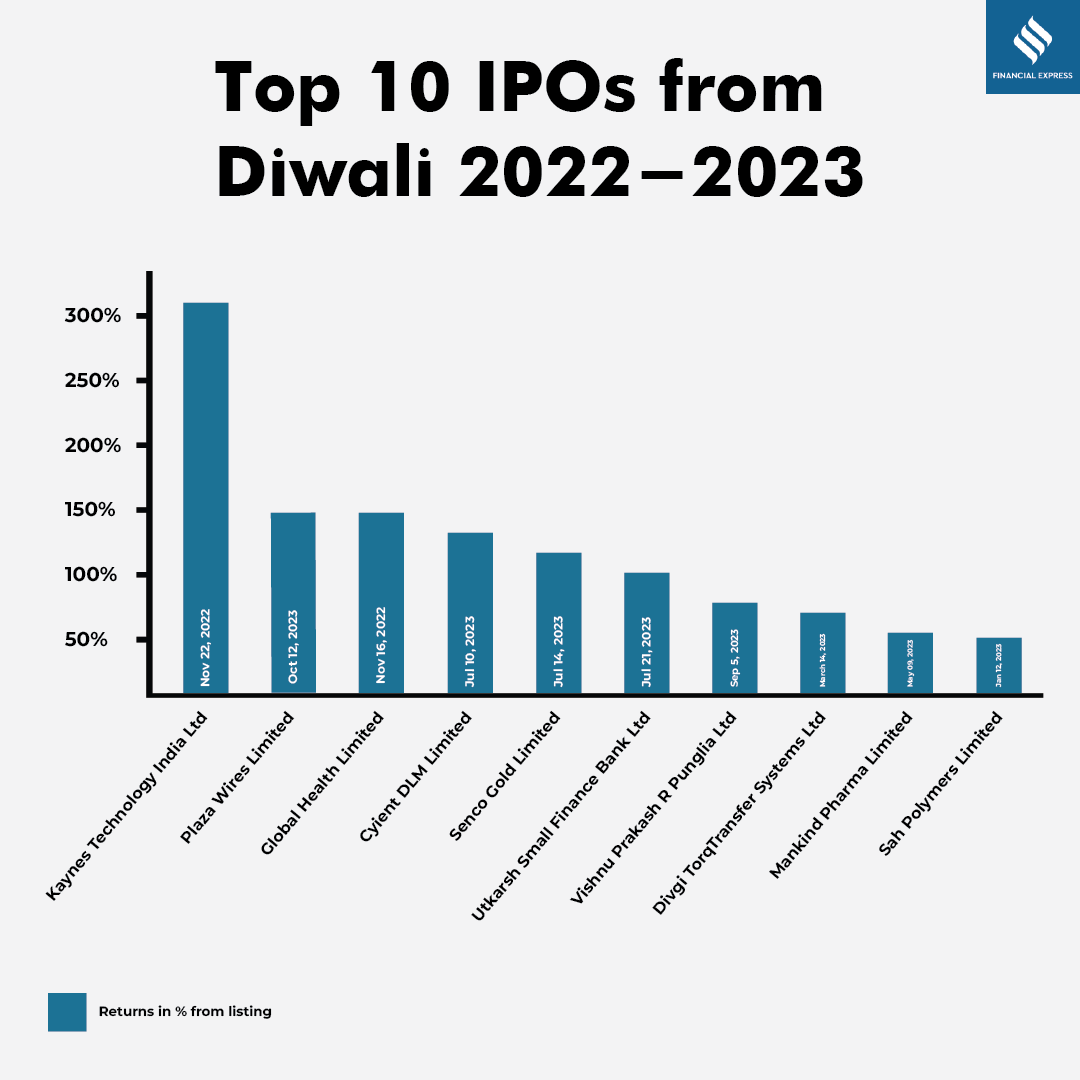

Notably, six companies have recorded returns of over 100%, while four have generated returns exceeding 60% over the past year. Additionally, 26 out of the 56 companies have provided returns between 10% to 49%.

Out of the 56 IPOs launched between Diwali 2022 and Diwali 2023, a significant 38 of them made their market debut after March, injecting vitality and dynamism into the market. Notably, Kaynes Technology, which entered the market in November 2022, leads the pack as the top-performing stock. It debuted at a premium of around 17 percent and is now trading a remarkable 319 percent above its issue price of Rs 587, with shares now trading over Rs 2,400 each.

Following closely behind are Electronics Mart, Plaza Wires, Cyient DLM, Global Health, Senco Gold, and Utkarsh Small Finance Bank, each offering impressive returns to investors. Electronics Mart and Plaza Wires witnessed gains of 48% and 43%, respectively, upon listing and currently trade at 140% and 149% above their issue prices.

Senco Gold, exhibiting an impressive spike of 128.28 percent, is followed by Utkarsh Small Finance Bank, which has surged by 106%, and Vishnu Prakesh R. Punglia, giving an impressive returns of 97%.

Meanwhile, the shares of Divgi TorqTransfer Systems Limited, Mankind Pharma, and Sah Polymers have not lagged behind, with gains exceeding 80%, 64%, and 62%, respectively.