Shares of Adani Group continued their bullish trend for the fourth consecutive day, propelling the conglomerate’s combined market capitalization to ₹14.8 lakh crore. The surge was led by Adani Total Gas, which soared by 20%, reaching a fresh 52-week high of ₹1,053.40. This marks a significant milestone as the stock surpassed the ₹1,000 mark for the first time since March 24, 2023.

Adani Ports and Special Economic Zone (APSEZ) and Adani Power also witnessed substantial gains, rallying over 7% each to achieve new 52-week highs of ₹1,082.50 and ₹589.45, respectively. Adani Energy Solutions surged nearly 12%, reaching a 52-week high of ₹1,246.00, while Adani Green Energy rose by 16% to ₹1,569.95. Adani Enterprises, the flagship firm, climbed 6%, reaching a day’s high of ₹3,154.55 on Wednesday.

The surge also follows a notable development last week when Adani Group stocks experienced their best day since a Supreme Court bench, led by Chief Justice of India DY Chandrachud, reserved its verdict in the Adani-Hindenburg row. The Supreme Court emphasized that the Securities and Exchange Board of India (SEBI) must conclude its investigation in all 24 cases related to the conglomerate.

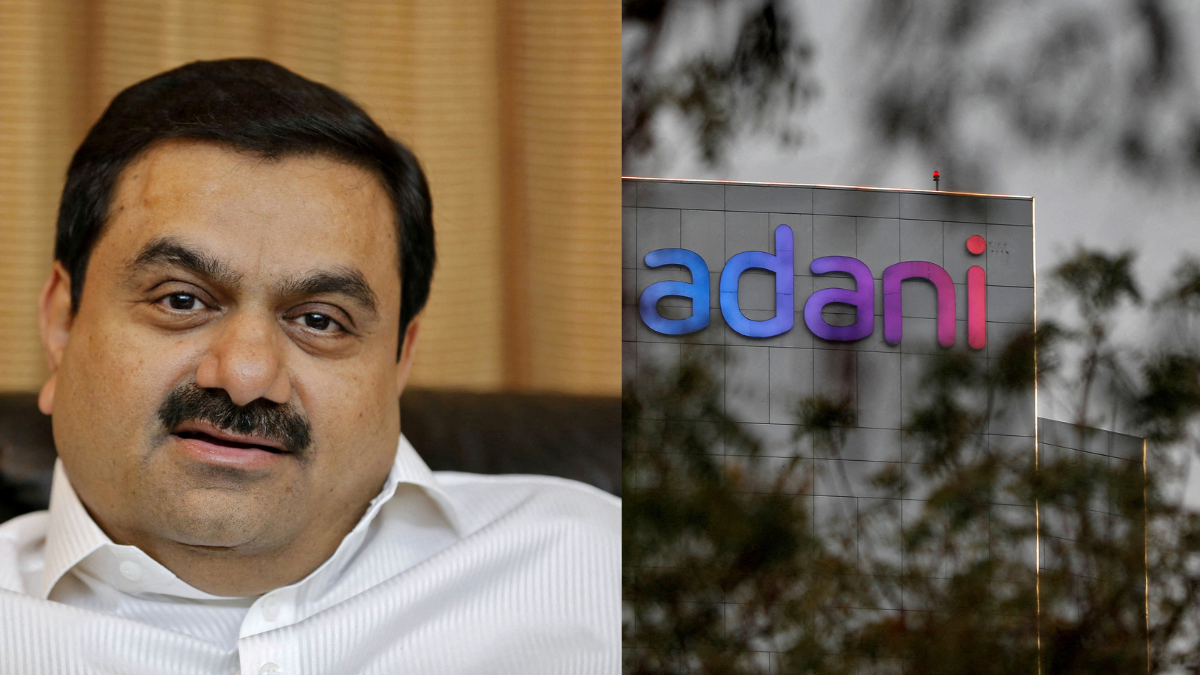

This upturn marks a significant recovery for Adani Group, which faced a downturn earlier in 2023 following a report by US-based short-seller Hindenburg Research. The report alleged financial wrongdoing and stock manipulation by the conglomerate, a claim vehemently denied by the company. While the market valuation has rebounded from its all-time low of ₹6.8 lakh crore, it remains 50% below its peak of ₹24.8 lakh crore.

Market analysts attribute the recent rally to the Bharatiya Janata Party’s election triumph in three states, exceeding exit poll predictions. The assembly election outcome is seen as a reaffirmation of consensus estimates predicting the BJP’s return to power in the 2024 Lok Sabha polls, thereby boosting market sentiment.